Dairy Products

Why trade Agricultural Derivatives on EEX?

- Hedging of price risks on the agricultural markets

- Financial settlement of all transactions based on reliable reference prices

- Access to a broad range of commodity products

- Safe and reliable clearing and settlement processes via European Commodity Clearing (ECC)

- Leading derivatives market for potatoes and dairy products in Europe

Financial Settlement

All products are settled financially upon maturity (cash settlement). In this process, reference prices adequately reflecting the value of the traded products are used. These price indices increase market transparency – also in the futures contracts.

Market indices as the basis for pricing on the dairy market

EEX European Butter, European Skimmed Milk Powder and European Whey Powder Indices

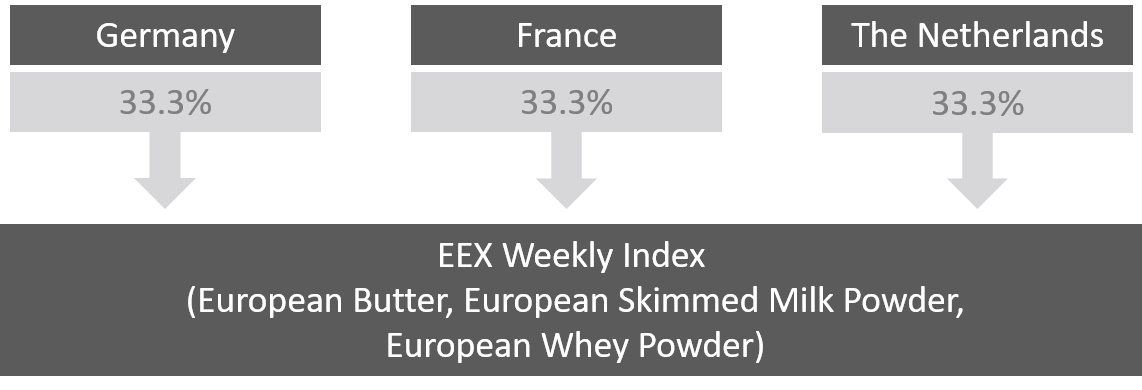

For the calculation of the EEX Weekly Indices renowned price assessments for Germany, France and the Netherlands are used as the data basis and combined into an unweighted average. As seen from a historical perspective, the correlation between these quotations is at a significantly high level. As a result, the indices reflect the market price of the referenced products within the European Economic Area.

Futures positions which are still open after the last day of trading are settled financially at the final settlement price. The final settlement price corresponds to the relevant EEX Monthly Index which represents the arithmetic mean of all published values of the related EEX Weekly Index during the respective month.

EEX Weekly European Cheese Indices (WECI)

The calculation of EEX Weekly European Cheese Indices (WECI) is based upon price contributions from participants in the European Physical Cheese Market. EEX has developed the index specifications and price reporting methodology to accurately reflect spot/nearby prices in the underlying physical market.

For each relevant cheese, EEX calculates an initial average value based upon prices received from all contributors. Prices submitted by individual contributors that deviate by more than 5% from this initial average value are eliminated after which a final average value is calculated. This final average value represents the index value for the relevant week.

The indices are published on Wednesdays and comprise the following:

- EEX Weekly European Cheddar Curd Index

- EEX Weekly European Mild Cheddar Index

- EEX Weekly Young Gouda Index

- EEX Weekly Mozzarella Index

EEX European Liquid Milk Index

The underlying data for the calculation of the EEX European Liquid Milk Index is the German price (”Preis für konventionell erzeugte Kuhmilch, bei 4,0 % Fettgehalt und 3,4 % Eiweißgehalt, ab Hof”) of the Bundesanstalt für Landwirtschaft und Ernährung (BLE).

Futures positions which are still open after the last trading day are settled financially at the final settlement price which corresponds to the respective market price index.

Contract specifications*

All products are offered for exchange trading on EEX. In addition, transactions concluded over the counter can also be registered for clearing (Trade Registration). Clearing and settlement of all transactions are provided by ECC, the clearing house of EEX Group.

EEX European Butter Future

| EEX European Butter Future | |

| Product ID | FABT |

| Product ISIN | DE000 A13RUP8 |

| Underlying | EEX Monthly European Butter Index |

| Contract volume/quotation | 5 metric tons |

| Denomination | EUR |

| Pricing and minimum price change | Pricing in EUR per tonne, minimum price change: EUR 1 per tonne |

| Maturities | At maximum, the following maturities can be traded on EEX: the maturities of the current and the respective next 19 consecutive calendar months |

| Trading hours | Trade Registration: 08:45 to 18:00 (CET); until 12:00 (CET) on the last trading day |

| Last day of trading |

|

| Settlement | Cash settlement, difference between the final settlement price and the settlement price of the previous exchange trading day |

| Final settlement price | Status of the respective decisive EEX Monthly European Butter Index on the last day of trading at 19:00 (CET) |

EEX European Skimmed Milk Powder Future

|

| EEX European Skimmed Milk Powder Future |

| Product ID | FASM |

| Product ISIN | DE000 A13RUM5 |

| Underlying | EEX Monthly European Skimmed Milk Powder Index |

| Contract volume/quotation | 5 metric tons |

| Denomination | EUR |

| Pricing and minimum price change | Pricing in EUR per tonne, minimum price change: EUR 1 per tonne |

| Maturities | At maximum, the following maturities can be traded on EEX: the maturities of the current and the respective next 19 consecutive calendar months |

| Trading hours | Trade Registration: 08:45 to 18:00 (CET); until 12:00 (CET) on the last trading day Exchange Trading: 08:55 to 18:00 (CET); until 12:00 (CET) on the last trading day |

| Last day of trading |

|

| Settlement | Cash settlement, difference between the final settlement price and the settlement price of the previous exchange trading day |

| Final settlement price | Status of the respective decisive EEX Monthly European Skimmed Milk Powder Index on the last day of trading at 19:00 (CET) |

EEX European Whey Powder Futures

|

| EEX European Whey Powder Futures |

| Product ID | FAWH |

| Product ISIN | DE000 A13RUN3 |

| Underlying | EEX Monthly European Whey Powder Index |

| Contract volume/quotation | 5 metric tons |

| Denomination | EUR |

| Pricing and minimum price change | Pricing in EUR per tonne, minimum price change: EUR 1 per tonne |

| Maturities | At maximum, the following maturities can be traded on EEX: the maturities of the current and the respective next 19 consecutive calendar months |

| Trading hours | Trade Registration: 08:45 to 18:00 (CET); until 12:00 (CET) on the last trading day Exchange Trading: 08:55 to 18:00 (CET); until 12:00 (CET) on the last trading day |

| Last day of trading |

|

| Settlement | Cash settlement, difference between the final settlement price and the settlement price of the previous exchange trading day |

| Final settlement price | Status of the respective decisive EEX Monthly European Whey Powder Index on the last day of trading at 19:00 (CET) |

EEX European Liquid Milk Futures**

|

| EEX European Liquid Milk Futures |

| Produkt ID | FALM |

| Produkt ISIN | DE000 A2G9 892 |

| Underlying | EEX European Liquid Milk lndex |

| Contract volume/quotation | 25,000 kilogram |

| Denomination | EUR |

| Pricing and minimum price change | Pricing in EUR per 100 kilogram, minimum price change: EUR 0.01 per 100 kilogram |

| Maturities | At maximum, the following maturities can be traded on EEX: the maturities of the current and the respective next 19 consecutive calendar months |

| Trading hours | Trade Registration: 08:45 to 18:00 (CET); until 12:00 (CET) on the last trading day Exchange Trading: 08:55 to 18:00 (CET); until 12:00 (CET) on the last trading day |

| Last day of trading | The 20th calendar day of the month. If this day is a weekend day or public holiday, the following exchange day is the last day of trading. |

| Settlement | Cash settlement, difference between the final settlement price and the settlement price of the previous exchange trading day |

| Final settlement price | Status of the respective EEX European Liquid Milk lndex on the last day of trading at 13:00 hrs (CET/CEST) |

*Please note that this document is exclusively intended for you information and is not legally binding. The legally binding contract specifications are available on the EEX website at Trading > Rules and Regulations.

**Update as of 2 September 2024: Adjustments to EEX European Liquid Milk Index and EEX European Liquid Milk Futures. Find all details in the EEX Customer Information here.