Environmental Indices

Benchmark and track carbon price globally with our robust suite of carbon-related indices. Based on a broad covering and long-term experience, EEX offers tailored insights and market intelligence.

EEX CBAM Reference Price

The EEX Carbon Border Adjustment Mechanism Reference Price (CBAM Reference Price) allows businesses to assess the cost of carbon related with the import of goods into the EU under CBAM. With CBAM Reference Price we offer reliable and transparent information on the anticipated costs for importers. The figure is calculated weekly on Friday and published at 1 pm CE(S)T reflecting the volume weighted average of the EUA auctions clearing prices of the current week taken out by EEX.

In offering transparent price information, we want to support companies in understanding the impact on their businesses. The final price for CBAM certificates will be published by the European Commission.

EEX Global Carbon Indices

The EEX Global Carbon Indices are designed to track the performance of major global compliance carbon markets.

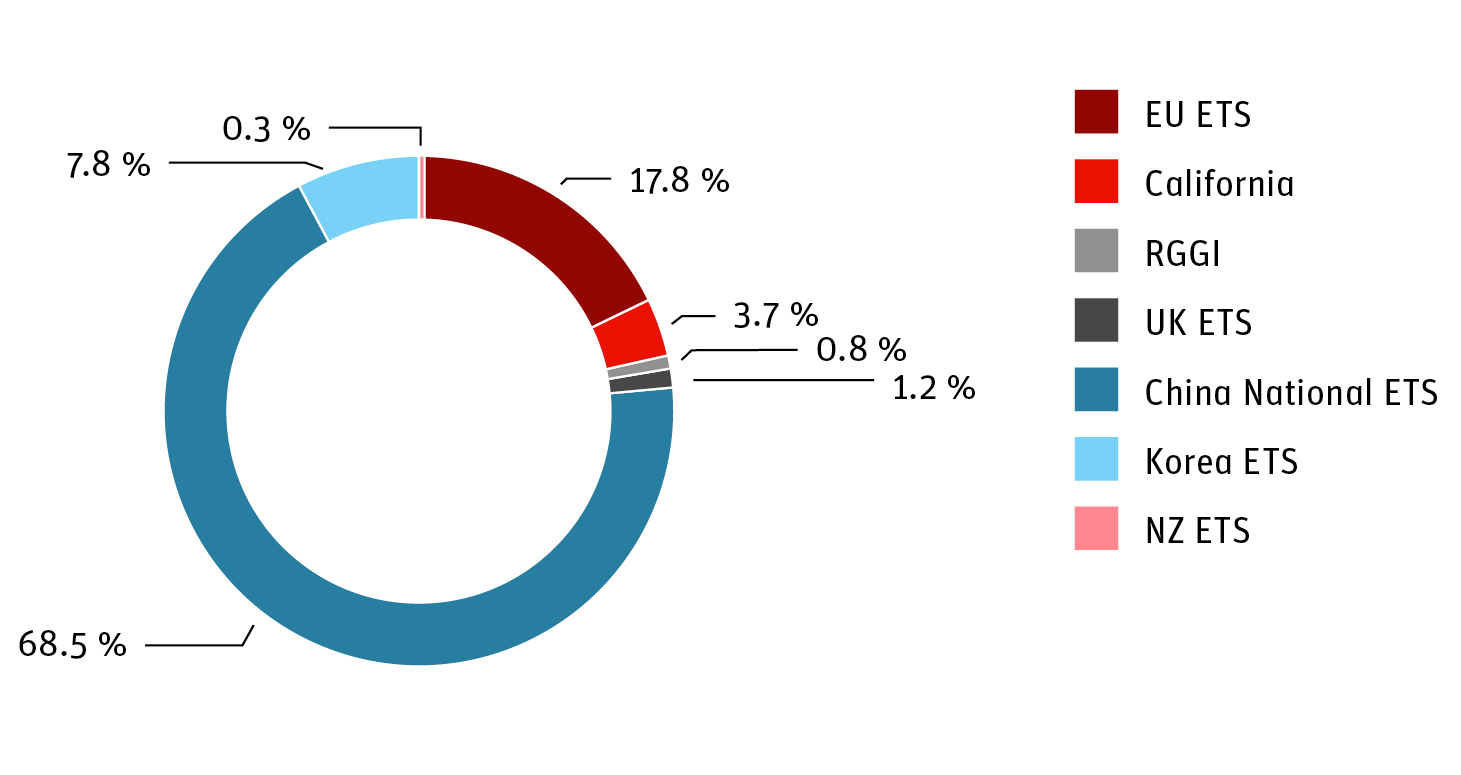

There is a strong global trend towards carbon pricing. About two-thirds of Nationally Determined Contributions (NDCs) under the Paris Agreement consider using carbon pricing to achieve emission reduction targets. As of 2022, about 17.7% of global emissions are covered by emissions trading schemes (ETS) – this share has increased strongly over the past years.

With the introduction of the EEX Global Carbon Indices, EEX supports global climate ambition by providing a daily approximation for a global carbon price. The indices are provided in both Euro and US Dollars.

*Disclaimer

These indices are published for information purposes only. Any commercial usage is forbidden. In particular, it is strictly forbidden to use these indices as the basis for financial or other derivative products. EEX AG provides all indices “as is”. EEX AG and any third party providing input data to the indices (“Data Provider”) make no representation and give no warranty, express or implied, regarding the indices, including (without limitation) in relation to their availability, suitability, quality, accuracy, timeliness, and/or completeness, and EEX AG and the Data Providers assume no liability in this regard. Any use of these indices is at the own risk of the user. Data Providers do not sponsor, endorse or recommend the indices provided by EEX AG.

EEX Global Carbon Index Family Advisory Committee

The EEX Global Carbon Index Core and the EEX Global Carbon Index Extended are complemented by the EEX Global Carbon Index Family Advisory Committee, which brings together the expertise of key players in carbon markets from the industrial sector, finance, and international organisations.

The main purpose of the Committee is to provide guidance or share experience with respect to the identification of eligible constituents of the index to be in line with the selection criteria. EEX may consult with the EEX Global Carbon Index Family Advisory Committee to assess the eligibility of potential future index constituents as well as potential future ineligibility of existing index constituents based on liquidity and maturity of the respective ETS. The Committee may also provide advice or share experience on market developments as well as recommendations on potential changes to the rules or the inclusion of additional indices.

The Committee uses all reasonable efforts to ensure that the main objective for the EEX Global Carbon Index Core and Extended is met: the provision of a clear and comprehensive picture of price developments in major carbon markets.

These are the current members of the committee**:

| Name | Company / institutional affiliation |

|---|---|

| Dario Pabst (Desk Manager) | ACT Financial Solutions |

| Christian Alexander Müller (Head of Carbon Pricing/Emissions Trading) | Evonik Operations GmbH |

| Theresa Wildgrube (Senior Carbon Markets Expert) | International Carbon Action Partnership |

| Izabela Ziegenhan (Carbon Market Analyst) | RWE Supply & Trading GmbH |

| Franz Pesendorfer (Managing Director, Strategic Commodity Solutions) | UniCredit Bank AG |

| Gergely Szabo (Investment Strategist) | Vertis Environmental Finance Ltd. |

| Joseph Pryor (Senior Climate Change Specialist) | World Bank |

| Ingo Ramming (Head of Carbon Markets) | BBVA |