Potatoes

Why trade Agricultural Derivatives on EEX?

- Access to a broad range of commodity products

- Hedging of price risks on the agricultural markets

- Financial settlement based on reliable reference prices

- Safe and reliable clearing and settlement processes via European Commodity Clearing (ECC)

- Leading derivatives market for potatoes and dairy products in Europe

Market price indices as the basis for prices on the potato market

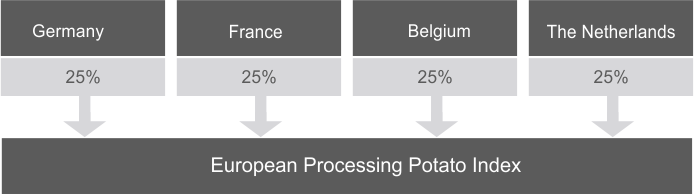

In the calculation of the index, recognised prices determined in Germany, France, Belgium and the Netherlands are used and condensed into an unweighted mean for one decitonne (100 kilograms) – the “European Processing Potato Index”. Historically, there is a 96 to 99 percent correlation between these listings. As a result, the index reflects the market price for processing potatoes for the production of chips within the European Economic Area.

Until further notice, the price base is determined with the help of the parameters listed below:

- Processing potatoes for the production of chips

- Tuber size: 40mm +

- Portfolio of potato types: Fontane, Agria as well comparable types in terms of pricing and processing technology

Futures positions which are still open after the last day of trading are settled financially at the final settlement price. This corresponds to the respective market price index.

Financial settlement

Potato futures are settled in the context of cash settlement upon maturity. In financial settlement reference prices are used which represent the value of the products actually traded (spot price). In all futures contracts, market price indices are used which reflect the market price and increase the transparency of the market as a result.

Contract specifications*

| Potato Futures (EEX European Processing Potato Futures) | |

|---|---|

| Product ID | FAPP |

| Product ISIN | DE000A13RUL7 |

| Underlying | European Processing Potato Index |

| Contract volume/quotation | 25 metric tons |

| Denomination | EUR |

| Pricing and minimum price change | Pricing in EUR per 100 kg; minimum price change: EUR 0.1 per 100 kg |

| Maturities | The next three maturity months from the April, June and November cycle as well as the respective following maturity month of April |

| Trading hours | Trade Registration: 09:50 to 16:00 (CET); until 16:00 (CET) on the last trading day |

| Last trading day |

|

| Settlement | Cash settlement, difference between the final settlement price and the settlement price of the previous exchange trading day |

| Final settlement price | Status of the respectively applicable index on the exchange trading day after the last day of trading, 9:30 (CET) |

*Please note that this document is exclusively intended for your information and is not legally binding. The legally binding contract specifications are available on the EEX website at Trading > Rules and regulations.