MiFID II / MiFIR Reporting

Reporting Regulation MiFID II Directive No. 2014/65/EU and MiFIR Regulation (EU) No. 600/2014

Reporting Obligation Overview

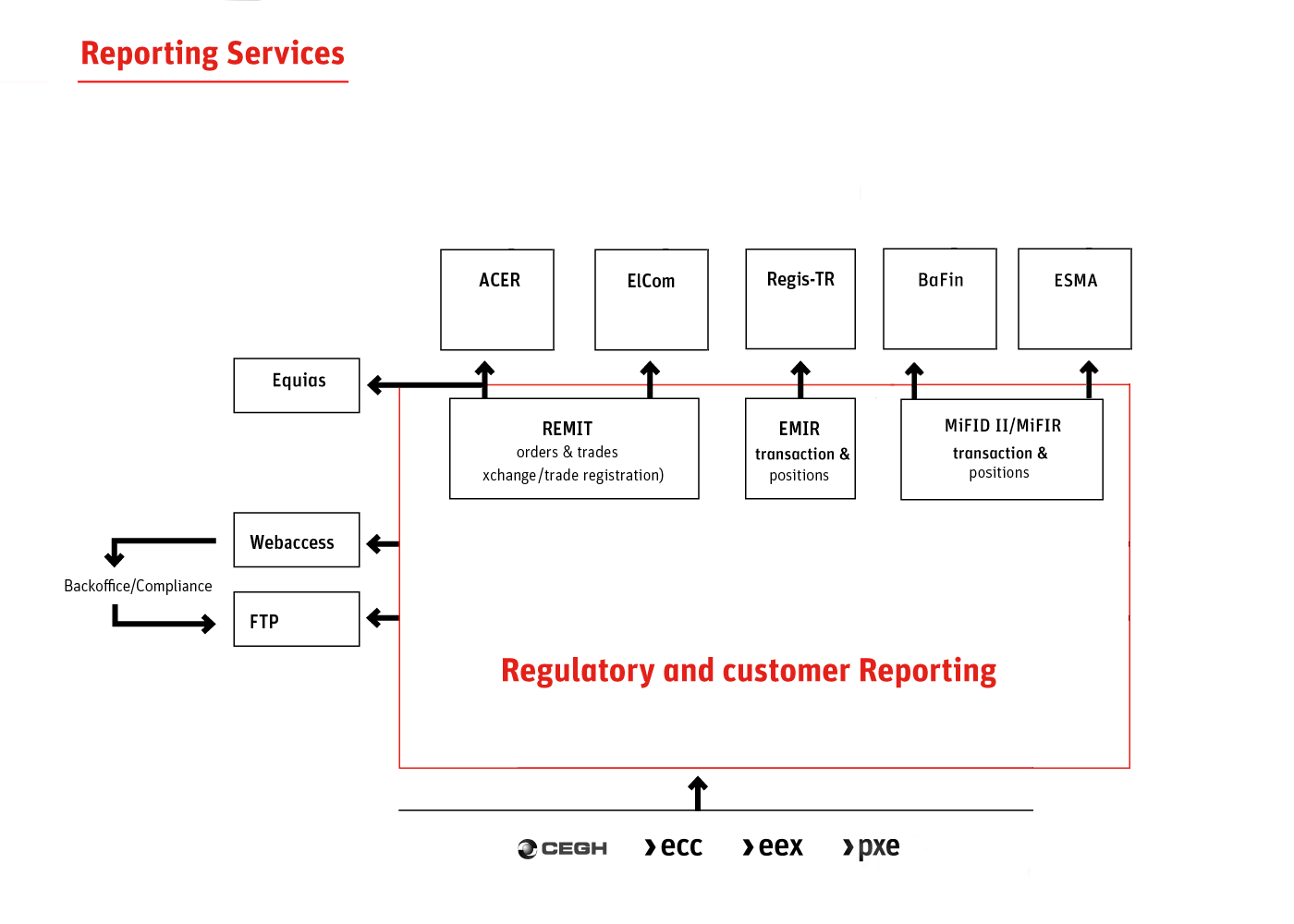

MiFID II/MiFIR Reporting within our Reporting Services Framework

Financial Instruments Directive (MiFID II) and the accompanying Markets in Financial Instruments Regulation (MiFIR) regulate the provision of investment services in a wide range of financial instruments on regulated trading venues as well as in over the counter (OTC) trading.

The MiFID II / MiFIR functionality is aligned with EEX AG's other regulatory reporting services for REMIT and EMIR using the same infrastructure, member access mechanisms as well as a common source of exchange, clearing and configuration data to best serve your needs.

MiFID II and MiFIR entered into force on 3 January 2018 with the aim to strengthen the stability and integrity of the financial market. These two reporting obligations require on each business day a reporting of positions (end-of-day) and transactions traded in the commodity derivatives and emission allowances. For EEX AG, the reporting must be provided to the related National Competent Authority (NCA) BaFin.

| Publishing date | Title | File |

|---|---|---|

| 2025-01-02 | MiFID II/MiFIR Reporting Description | pdf (2 MB) |

| 2024-06-13 | MiFID/MiFIR Reporting Agreement - Participation Form | pdf (338 KB) |

| 2024-06-13 | MiFID/MiFIR Reporting Agreement - General Conditions | pdf (350 KB) |

| 2024-04-29 | EEX Group Holiday Calendar | pdf (102 KB) |

| 2024-04-11 | Primary Auction Transaction Reporting Agreement | pdf (323 KB) |

Position Reporting

Overview

- As part of MiFID II, there is an obligation for EEX AG to submit a daily position report to the National Competent Authority BaFin (Article 58, paragraph 1).

EEX leverages ECC position data to daily generate a draft report with all the information available for each reporting participant. - Reporting participants are required to support the position reporting of the trading venue (Article 58, paragraph 3) and can do so using the regulatory reporting solution of EEX AG.

- Members can access and amend the draft reports provided by EEX AG.

- Members need to contribute additional information not available to the exchange.

- In case the reporting participant does not provide an amended report within the defined timeframe, EEX AG will submit the draft report.

- Positions breakdowns on client level can be created based on the draft reports generated by EEX AG.

Standard Workflow

- EEX AG: Provision of MiFID instrument files on the SFTP server earliest at 00:45 a.m. CE(S)T

- EEX AG: Provision of draft reports on the SFTP server between 06:00 and 10:00 a.m. CE(S)T

- Participant: Amendment of draft reports until 02:00 p.m. CE(S)T

- Participant: Upload of a valid participant report until 02:00 p.m. CE(S)T

- EEX AG: Submission of the latest valid participant report to BaFin after 02:00 p.m. CE(S)T

Draft Reports

EEX AG will prepare a full position report in the ITS4 format. The draft reports are based on ECC’s position data with all information available to the exchange.

The draft report will always be based on the assumption that the trading participant is the end-client in accordance with the regulation.

Position Data to be Reviewed and Amended

Reporting participants are required to review and provide additional data:

- Position Holder ID

- Position Holder Category

- Email address of position holder

- Ultimate Parent LEI or National ID

- Email address of ultimate parent entity

- Parent of collective investment scheme status

- Risk-reducing indicator

- EEX will provide the instrument data needed for the report creation

Member Access to Draft Reports and Report Submission

- Reporting Participants can download the draft reports from the Reporting Services SFTP server, make amendments and upload new versions.

- Uploaded reports must include all records.

- Each reporting participant will receive an individual password as well as a username to access the server. A precondition is the provision of a public key and a public IP that needs to be whitelisted by EEX AG.

- EEX AG will submit the reports directly to BaFin.

Schema

The Financial Conduct Authority of Great Britain (FCA) is the only National Competent Authority (NCA) with a published ITS4 adaptation (XML schema and reporting guideline).

Other NCAs have not published technical interface specifications or a schema file.

EEX suggests the usage of the FCA schema to our relevant NCAs, and therefore bases its planning activity on this structure.

FIA and EFET have jointly published an extended Position Reporting Schema based on multiple workshops with industry partners to cover the member to exchange position reporting. This extended schema is based on the FCA’s schema version used for the exchange to NCA communication:

- Full consistency for all attributes included in the FCA schema

- Additional (optional) attributes added where required by trading venues or firms for internal processes

EEX uses the extended schema for data exchange with reporting participants and assumes that the original FCA schema can be used for data exchange with all relevant NCAs.

Further details about the daily workflow, required data for positions and the technical specifications can be found in the MiFID II/MiFIR reporting description.

Transaction Reporting

Overview

As part of MiFIR, there is an obligation for EEX AG exchanges to submit a daily transaction report for non-investment firms and third-country firms to the relevant National Competent Authority (NCA) BaFin (§ 26.5, RTS 22).

EEX Group will leverage ECC‘s position transaction data as well as trade data from the trading system (T7) and combine this information with instrument reference and configuration data provided by the reporting participants to create a draft transaction report.

Reporting Participants are required to support the transaction reporting of the trading venues and can do so using the regulatory reporting solution of EEX AG.

Reporting Participants need to access, review and - if required - amend the draft reports.

Investment firms have the obligation to submit MiFIR transaction reports to their relevant NCA themselves. For investment firms EEX AG is able to offer the same draft report creation service as stated above. None-the-less it is assumed that an investment firm might have more complex amendment requirements and in addition to the draft reports, further measures need to be implemented.

Standard Workflow (identical to position reporting)

- EEX AG: Provision of MiFID instrument files on the SFTP server earliest at 00:45 a.m. CE(S)T

- EEX AG: Provision of draft reports on the SFTP server between 06:00 and 10:00 a.m. CE(S)T

- Participant: Amendment of draft reports until 02:00 p.m. CE(S)T

- Participant: Upload of a valid participant report until 02:00 p.m. CE(S)T

- EEX AG: Submission of the latest valid participant report to BaFin after 02:00 p.m. CE(S)T

Draft Reports

EEX AG will prepare a transaction draft report based on ECC position transaction data as well as T7 trade data.

Transaction Data to be Reviewed and Amended

Reporting participants are required to provide additional data:

- Trading Capacity

- Short code translation details e.g. investment decision, executing trader, buyer/seller details

- Branch Country

- Risk-reducing indicator

- EEX will provide the instrument data needed for the report creation

Member Access to Draft Reports and Report Submission

- Reporting Participants need to download the draft reports from the Reporting Services SFTP server, make amendments and upload new versions

- Uploaded reports must include all records

- Each reporting participant will receive an individual password as well as a username to access the server. A precondition is the provision of a public key and a public IP that needs to be whitelisted by EEX AG.

- EEX AG will submit the reports directly to BaFin.

Schema

EEX AG uses the transaction report format as defined in the latest version of the Regulatory Technical Standards (RTS 22) of the European Commission (COMMISSION DELEGATED REGULATION (EU) 2017/590).

The XML schema (.XSD) implemented by EEX AG for data exchange with reporting participants and NCAs is based on the Transaction Reporting XML Schema 1.1.0 by ESMA.

Further details about the daily workflow, required data for transactions and the technical specifications can be found in the MiFID II/MiFIR reporting description.

MiFID II EUREX Reporting

Under Art. 58.1 MiFID II Eurex Deutschland as a regulated market is required to provide BaFin with daily reports on the positions held by their clients (and the clients of the clients up to the end client) in listed commodity derivatives, emission allowances and derivatives thereof.

To enable Eurex Deutschland to fulfil its reporting obligation, the related exchange participants need to comply with Art. 58.3 MiFID II and provide breakdowns of their positions and positions of their clients (on end-customer level) in listed commodity derivatives to that trading venue (i.e. Eurex Deutschland) on a daily basis (t+1) until 2pm CE(S)T the latest. EEX AG submits the participant reports on behalf of EUREX and has implemented an interface to provide position data for the commodity derivatives traded on Eurex.

| Publishing date | Title | File |

|---|---|---|

| 2022-03-23 | EUREX MiFID II Data Service Description | pdf (451 KB) |

| 2022-03-23 | General Conditions to the MiFID II EUREX Reporting Agreement | pdf (216 KB) |

| 2022-03-23 | Participation Form to the MiFID II EUREX Reporting Agreement | pdf (131 KB) |

Reports

RTS 2 pre-trade transparency

EEX provides the pre-trade transparency data for trading via the respective market data system of the Deutsche Börse Group.

More detailed information are published here.

Please be aware that the quotation time is displayed in UTC.

Commitment of Traders (CoT) Report

The Commitment of Traders (CoT) report covers the following categories to the nature of your firm’s main business pursuant to Article 58 para 4 MiFID II in conjunction with the requirements set out in Commission Implementing Regulation (EU) 2017/1093 (ITS 4) for the weekly reports, taking into account any applicable authorisation:

- Investment firms or credit institutions

- Investment funds

- Other financial institutions

- Commercial undertakings

- Operators with compliance obligations under Directive 20003/87/EC

The information in the report indicates the open interest of derivative contracts of both long and short positions and illustrates which category of market actors is involved.